Breaking the Cycle: Can Gold Outshine Historical Trends in September?

As September begins, gold is facing a familiar challenge — the month is historically marked by price declines.

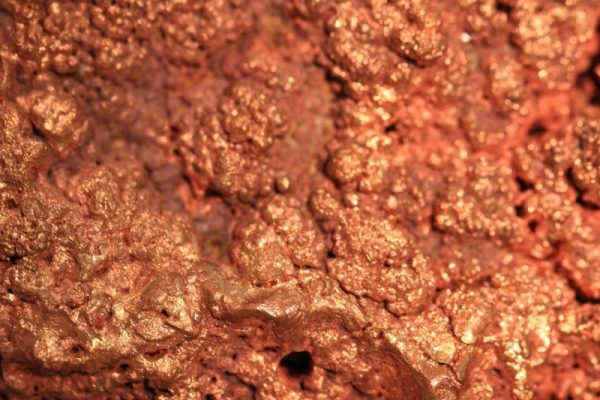

Despite its strong performance so far this year, which has seen the yellow metal reach an all-time high of US$2,531.70 per ounce, market participants are now closely watching whether these gains will persist.

According to Bloomberg, since 2017 the precious metal has consistently suffered a ‘September curse,’ averaging a 3.2 percent decline during the period — the steepest drop of any month in the year.

September is also typically the worst month for US stocks, but a strong month for the American dollar.

This pattern has raised concerns among investors and analysts alike, who are debating whether the factors that have bolstered gold throughout 2024 will be able to counteract its typical seasonal weakness.

A key driver behind gold’s price surge has been geopolitical uncertainty, particularly Russia’s ongoing conflict with Ukraine and tensions in the Middle East. These factors have heightened demand for gold as a safe-haven asset.

Expectations that the US Federal Reserve will cut interest rates have also boosted gold. Anticipation of these cuts has bolstered its price by reducing the appeal of the US dollar, which traditionally has an inverse relationship with gold.

‘We still see very significant value in long gold positions, and maintain our bullish $2,700 forecast for 2025. Fed rate cuts are poised to bring Western capital back into the gold market,’ Lina Thomas, commodities strategist at Goldman Sachs (NYSE:GS), told Reuters last month. The Fed’s next meeting will run from September 17 to 18.

The reason for gold’s recent September dips may be related to a ‘sell in May and go away’ philosophy from traders. Bloomberg notes that some choose to buy gold to hedge against volatility while they are on vacation, only to offload their positions when they return in the fall and can participate the market more actively once again.

With that said, gold isn’t guaranteed to go down — the news outlet states that using a timeframe of three decades gold has actually risen in September. And there are a number of other factors that could help it sustain high levels.

Central banks, particularly China’s central bank, have been significant buyers of gold, a trend that has provided strong support for the metal. China’s gold-buying spree lasted 18 consecutive months until April of this year, and although it’s now taken a pause, the potential for renewed purchasing remains from the Asian nation and others remains.

As September continues, the question remains whether this and other supportive factors will be enough to offset the historical trend of declines. The outcome of the Fed’s meeting later this month, alongside geopolitical developments, will likely play a crucial role in determining whether gold can break the ‘September curse’ this year.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.