Stocks

Charting Forward: Opportunities You Can Seize in September

It’s a quiet end to August, with the broader stock market indexes wavering higher and lower. The Market Overview panel on the StockCharts Dashboard shows equity indexes closing higher. And yes, the Dow Jones Industrial Average ($INDU) closed at a record high. FIGURE 1. MARKET OVERVIEW PANEL IN THE STOCKCHARTS DASHBOARD. All broader indexes were…

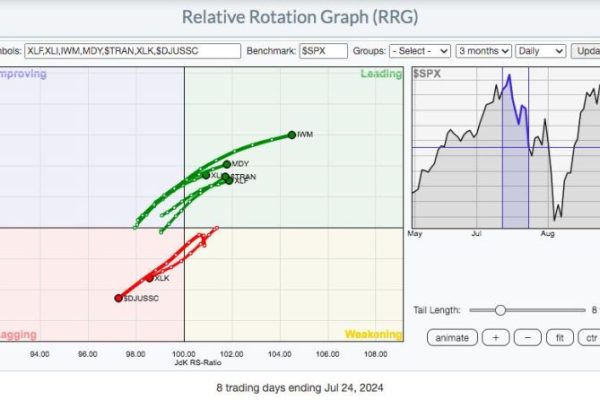

Recognize The New Leaders NOW!

We had a sneak preview of emerging leadership on the morning of July 12th. That was the morning the June Core CPI came in well below expectations. The immediate rotation into several areas was quite evident and you can see it right here on this RRG Chart: Financials (XLF), industrials (XLI), small caps (IWM), mid…

Week Ahead: Uptrend Stays Intact For NIFTY; RRG Shows Distinctly Defensive Setup

The past sessions for the markets stayed quite trending; the headline index continued with its upmove. While extending their gains, the Nifty 50 Index ended the week on a very strong note. Witnessing a strong momentum on the upside, the markets expanded their trading range as well. The Nifty traded in a range of 393.65…

Should You Buy the Dip in NVDA?

In this StockCharts TV video, Mary Ellen reviews the broader markets, including NASDAQ weakness, and the outperformance in the equal-weighted S&P 500. She examines NVDA and shares how you should trade the stock depending on your investment horizon. Last up, Mary Ellen reveals top stocks in leadership areas. This video originally premiered August 30, 2024. You…

What Would a Top in Semiconductors Mean for the S&P 500?

After Nvidia (NVDA) dropped after earnings this week, investors are once again reminded of the importance of the semiconductor space. I think of semis as a “bellwether” group, as strength in the VanEck Vectors Semiconductor ETF (SMH) usually means the broader equity space is doing quite well. Today, we’ll look at a potential topping pattern forming for…

Stock Market Today: Tech Tumbles as Mega-Cap Stocks Get Hit by Major Profit-Taking

I hope you had a relaxing, restful long weekend, and welcome to September. It was a pretty dismal post-Labor Day trading session. We all know September is the worst for stocks, but let’s hope the first day’s action doesn’t foretell how the rest of it will play out. All the broader equity indexes are down, with…

Why the S&P 500 Going Sideways is the Best Case Scenario

In this video from StockCharts TV, Julius evaluates the completed monthly charts for August, noting the strength of defensive sectors. He then analyzes a monthly RRG and seeks alignment for the observations from the price charts. Could “sideways” be the most positive scenario for the S&P 500 these next few weeks? This video was originally…

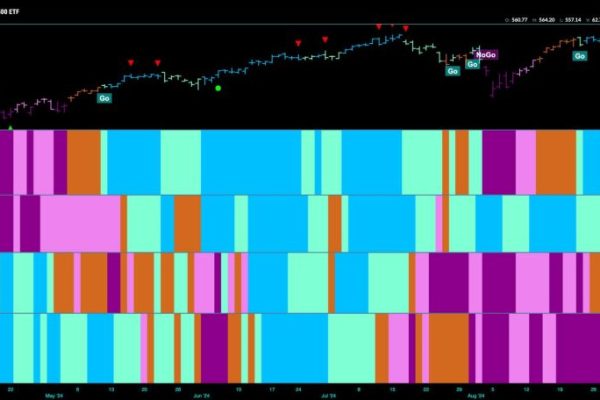

Equities Hold Firm in “Go” Trend as Industrials Play Strong Defense

Good morning and welcome to this week’s Flight Path. Equities consolidated their new “Go” trend this week. We see that the indicator painted mostly strong blue bars even as price moved mostly sideways. Treasury bond prices remained in a “Go” trend but painted an entire week of weaker aqua bars. U.S. commodity index fell back into a “NoGo”…

Signing Off

Signing Off I want to thank the owner/President of StockCharts.com, Chip Anderson, and his son, Eric, for 25 years of friendship, over 10 years of writing 200+ articles in my “Dancing with the Trend” blog on StockCharts.com. StockCharts.com offers a giant selection of tools and material for investors and traders. Even if you do not classify yourself…

It all Started with a Big Bang!

Extended trends often start with big bangs and major breakouts. Chartists can identify “big bang” moves by showing price change in ATR terms. We can use the price charts to identify big breakouts. Today’s example will show Paypal (PYPL), which is part the FinTech ETF (FINX). The ChartTrader weekly report featured FINX because it broke…