Top 5 Most-popular Uranium Stories of 2024

As the year closes, we’re taking a look back at our most popular uranium news articles of 2024.

The uranium sector has been on a rollercoaster in 2024, a year that saw the uranium price break above US$100 per pound.

Countries concerned with the metal, especially the United States, China and Russia, were the drivers of some of the biggest uranium news items in 2024. News of a major acquisition also made the cut as one of the year’s biggest uranium headlines.

Read on for the list of our top five uranium stories of 2024, including updates on what has happened since.

1. Biden Signs Bill Banning Russian Uranium Imports, Restrictions to Begin in 90 Days

Among the biggest uranium news during the first half of 2024 is the United States’ Prohibiting Russian Uranium Imports Act, which was signed into law by US President Joe Biden on May 13 after it received unanimous approval in the Senate on April 30.

The act, which took effect on August 11, ended the country’s three-decade dependence on Russian uranium.

The US said that it is focused on American uranium production and enrichment. Centrus Energy (NYSEAMERICAN:LEU), the country’s biggest trader of enriched uranium from Russia, is also producing high-assay low-enriched uranium (HALEU) at the American Centrifuge Plant in Piketon, Ohio.

The Piketon demonstration project has reportedly enriched more than 100 kilograms of HALEU and is expected to ramp up production to 900 kilograms in the coming years.

Under the new law, the Department of Energy (DOE) is allowed to issue waivers authorizing Russian uranium imports according to limits established in an anti-dumping agreement. This usually is for cases where buyers are not able to find an alternative option.

The statute is set to expire at the end of 2040.

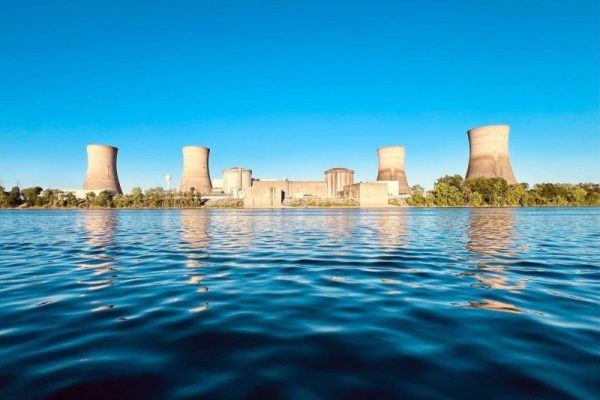

2. China Approves 11 Nuclear Reactors in US$31 Billion Green Energy Investment

China made headlines when it announced its approval of 11 nuclear reactors across five major areas: Jiangsu, Shandong, Guangdong, Zhejiang and Guangxi.

State-owned entities China National Nuclear (CNNC) and China General Nuclear Power Group (CGN) were assigned to oversee the construction of the majority of these projects.

According to China, the construction of these reactors forms part of its broader strategy to significantly increase its nuclear power capacity by 2035.

The country’s nuclear power capacity can cover about 5 percent of its electricity demand right now, and it plans to double this to 10 percent by 2035, coinciding with a massive expansion in wind and solar projects.

December 2024 statistics from the World Nuclear Association show that 65 reactors are under construction across the world, 29 of which are in China, with 90 more being planned globally.

3. Russia Restricts US Uranium Exports, Retaliating to American Ban

As a response to the US’ ban on Russian uranium imports, Russia announced its temporary restrictions on enriched uranium exports to the US on November 15.

The ban, which will be in place until December 31, 2025, applies to all products under the definition ‘uranium enriched with the isotope uranium-235” and does not include the exports under one-time licenses issued by the Russian Federal Service for Technical and Export Control.

Like the US’ allowance of waivers, the Russian decree also accounts for special cases where companies with permits from the export control watchdog are allowed to export uranium to the United States.

The move came two months after President Vladimir Putin said in a September 11 government meeting that Moscow should consider limiting exports of key metals such as uranium, titanium and nickel in retaliation for Western sanctions.

4. US to Spend US$2.7 Billion on Low-enriched Uranium from Domestic Sources

Nearly a month before the US ban on Russian uranium import took effect, the country said that its Department of Energy (DOE) would purchase up to US$2.7 billion worth of low-enriched uranium from domestic sources.

The proposal, issued on June 27, said that the purchase would “enhance national energy security and create new jobs in the nuclear industry.”

In December, the DOE penned supply contracts with six companies: Centrus Energy subsidiary American Centrifuge Operating, General Matter, Global Laser Enrichment, Louisiana Energy Services, Urenco USA’s Laser Isotope Separation Technologies and Orano Federal Services.

“(These companies) will be able to compete for future work to supply LEU, fostering strong commercial sector investment,” the DOE press release read.

According to the DOE, all contracts are valid for 10 years and each company receives a minimum contract of US$2 million.

This move, along with other initiatives, are discussed in the DOE’s Pathway to Advanced Nuclear Commercial Liftoff report, which supports the advancement of technologies that can help the US achieve net-zero emissions by 2050.

5. Paladin Energy to Acquire Fission Uranium in C$1.14 Billion Deal

The biggest uranium acquisition news of 2024 is the C$1.14 billion deal between Paladin Energy (ASX:PDN,OTCQX:PALAF) and Fission Uranium (TSX:FCU,OTCQX:FCUUF), which was announced on June 24.

The terms of the agreement state that “Paladin will acquire 100 percent of the issued and outstanding shares of Fission, while Fission shareholders will receive 0.1076 fully paid shares of Paladin for each Fission share they hold.”

Once completed, Paladin shareholders will hold 76 percent of the company, while Fission shareholders will collectively hold the remaining 24 percent.

Paladin received the final approval from Canadian authorities to perform the acquisition on December 18, and the deal officially closed on December 23.

“The combination of Paladin and Fission creates a world-class diverse uranium producer operating in multiple countries, with a high-quality portfolio of production, development and exploration assets,” Paladin CEO Ian Purdy said in a December 19 press release.

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.